how to file tax for sole proprietorship in malaysia

Tax Accounting. What Bloggers Influencers and Freelancers Need To Know About Taxes in Malaysia David Wang I co.

An Overview Of Pass Through Businesses In The United States Tax Foundation

For a corporation or LLC taxed as a corporation contributions must be made by the end of a calendar year.

. Search IDRS to verify if the EIN is associated with a sole proprietorship partnership or corporation and. If you are planning to file for divorce in Pennsylvania you will need to know the numerous forms used in PA divorce cases and understand their Oct 07 2022 4 min read Your Guide to Florida Divorce Forms. The sole trader receives all profits subject to taxation.

Sole traders may acquire a unique New Zealand Business Number NZBN which any business in New Zealand can use. If you are planning to file for divorce in Pennsylvania. All profits and losses go directly to the business owner.

Limited liability company LLC A hybrid legal structure that provides the limited liability features of a corporation and the tax efficiencies and operational flexibility of a partnership. Tax on Unrecognised Provident Fund. Do you live in Texas and need to file for divorce.

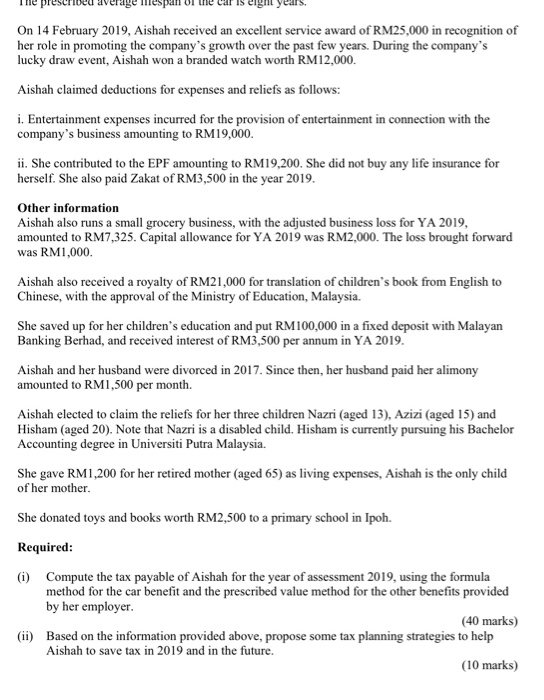

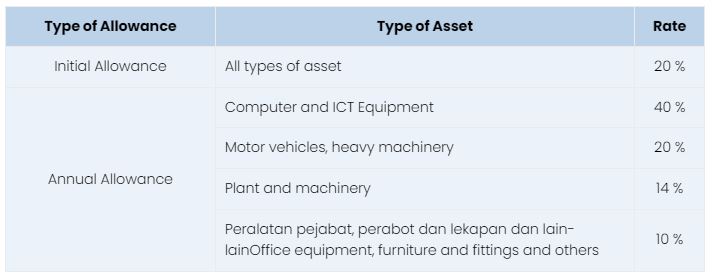

In general a tax invoice should be issued within 30 days from the time of supply. A sole proprietorship also known as a sole tradership individual entrepreneurship or proprietorship is a type of enterprise owned and run by one person and in which there is no legal distinction between the owner and the business entityA sole trader does not necessarily work alone and may employ other people. Instead of filing Form BE which is filed by individuals under employment or having non-business income sole proprietors file Form B before 30 June on a yearly basis.

Find out more about VAT in Cambodia below. Sole proprietorship tax return filing The proprietorship firm can use ITR-4 for tax filing under a presumptive tax scheme. With workflows optimized by technology and guided by deep domain expertise we help organizations grow manage and protect their businesses and their clients businesses.

Company Secretary Service in Malaysia- Yearly Fees RM 360. Tax on Statutory Provident Fund. Bhd as part of its name.

Partnership firms including Limited Liability Partnership LLP tax return filing Partnership firms registered or unregistered are required to file income tax returns in form ITR 5 each year. A qualified personal residence trust or QPRT can provide estate and gift tax savings but they also can be complicated to set up and maintain May 02 2022 3 min read Estate Planning. Under the rules of this section and 3017701-3 an eligible entity with more than one owner in Country A is treated as a partnership for federal tax purposes absent an election to be treated as an associationP files a certificate of continuance in Country B as an unlimited company.

VAT rates in Cambodia. Sole Proprietorship Malaysia Comparing with SDN BHD. An unincorporated business without legal distinction between the company and the individual running it.

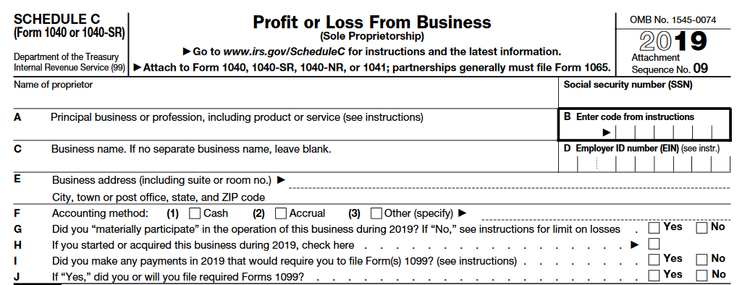

P is an entity with more than one owner organized in Country A as a general partnership. Income tax filing for sole proprietors is straightforward. For a sole proprietorship partnership or an LLC taxed as a sole proprietorship the deadline for depositing contributions is generally the personal tax filing deadline April 15 or September 15 if an extension was filed.

Enabling tax and accounting professionals and businesses of all sizes drive productivity navigate change and deliver better outcomes. A private company contains the term Sendirian Berhad meaning Private Limited or Sdn. Affected registered business enterprises RBEs in the IT-business process management IT-BPM sector that intend to transfer registration from the Philippine Economic Zone Authority PEZA to the Board of Investments BOIDepartment of Trade and Industry DTI to adopt 100 percent work from home WFH arrangement without.

A sole proprietorship in Malaysia makes no difference between the natural person who owns it and the businessSole proprietorships are pass-through entities. The Nations Leading Newspaper. Sole proprietorship person fizik A business owned and managed by one individual who is personally liable for all business debts and obligations.

Famous Sole Proprietorship Examples is a Sole traders in New Zealand must inform the Inland Revenue Department that they are trading and register for Goods and Services Tax purposes if their income exceeds 60000 USD per year. Energy policy is the manner in which a given entity often governmental has decided to address issues of energy development including energy production distribution and consumptionThe attributes of energy policy may include legislation international treaties incentives to investment guidelines for energy conservation taxation and other public policy techniques. If you need any assistance in tax filing and payment please feel free to contact SF Consulting.

Potentially receive a lower tax bill. Separate credit rating from your personal score. Your tax invoice must also provide details on exempt zero-rated or other supplies if applicable.

Employer contributions to a provident fund are tax-deductible. Secure business funding more easily. Changing the name on your Social Security card is simple as long as you provide the necessary original documents and the required form.

Thereby no separate tax return file is neededSole proprietorships in Malaysia are charged the income tax on a gradual scale applied to the individual income from. Especially if you are a new tax payer or if you have joined a new company have to file income tax. Some goods and services in Cambodia are subject to value-added tax VAT while others are not subjected to any VAT or are applicable to claim zero-rated VAT.

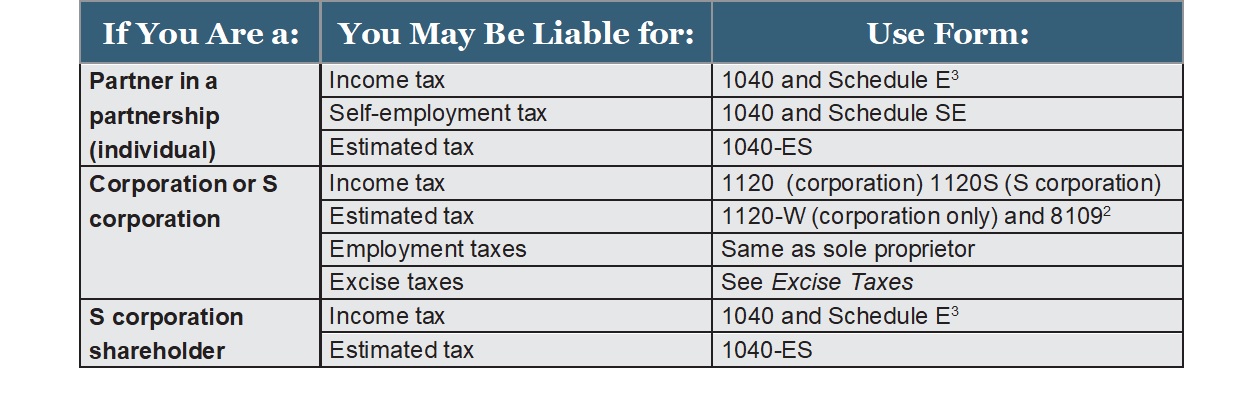

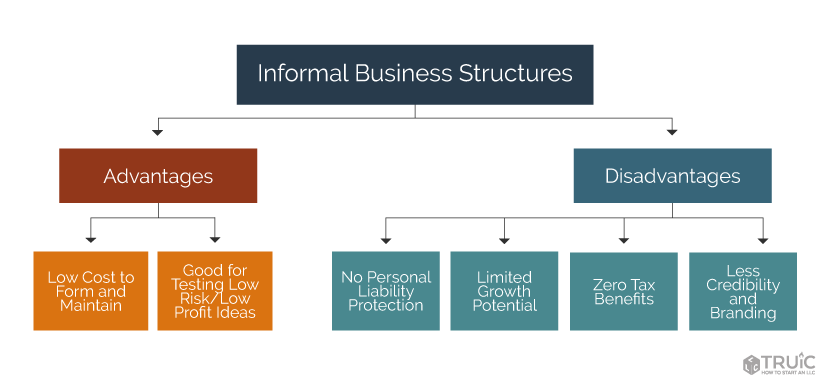

Common business structures for new business owners include. Pursuant to Treasury Regulation Section 16012-1a5 an individual taxpayer required to file an income tax return other than a Form 1040NR must indicate on Form 2848 Line 5a that the representatives is authorized to sign the. SP Sole Proprietorship GP General Partnership.

Value-added tax VAT is a tax that is added to the price of goods or services provided by a company. The employers contribution to the provident fund is tax-free while the employees contribution is taxed. Climate of Malaysia.

For a public company Berhad or Bhd is used. For many small-scale online businesses in Malaysia Sole Proprietorship single owner or Partnership more than one owner is enough and the cheapest option. If you are planning to file for divorce in Pennsylvania you will need to know the numerous forms used in PA divorce cases and understand their Oct 07 2022 4 min read Your Guide to Florida Divorce Forms.

There are three main types of business entity in Brunei namely sole proprietorship partnership and company. How To File Your Income Tax As A Freelancer CompareHero. Tax-free interest and retirement payments are credited to the provident fund.

A tax invoice need not be issued for zero-rated supplies exempt supplies and deemed supplies or to a non-GST registered customer. In the process of filing Form B a sole proprietor needs to prepare various information to determine the chargeable.

How To File Income Tax In Malaysia Using E Filing Mr Stingy

Choosing A Business Entity In The Usa Htj Tax

How To File A Small Business Tax Return Process And Deadlines

Aishah The Sole Proprietor Of A Food Catering Chegg Com

Sole Proprietor Tax Forms Everything You Ll Need In 2022

9 Common Types Of Business Structures 2022 Shopify Malaysia

Kyle Meissner Are You Paying Yourself Correctly Business World Wenatcheeworld Com

Taxes For Bloggers How To File Taxes On Your Blogging Income 2022

Business Structure Choosing A Business Structure Truic

5 Tips For Sole Proprietors In Malaysia Lhdn Borang B Tax Filing Youtube

How To File Income Tax For Your Side Business

Sole Proprietor Vs Independent Contractor Oyster

A Guide To Sole Proprietorship Taxes

Amini Conant Sole Proprietor Taxation Business Tax Lawyer Amini Conant

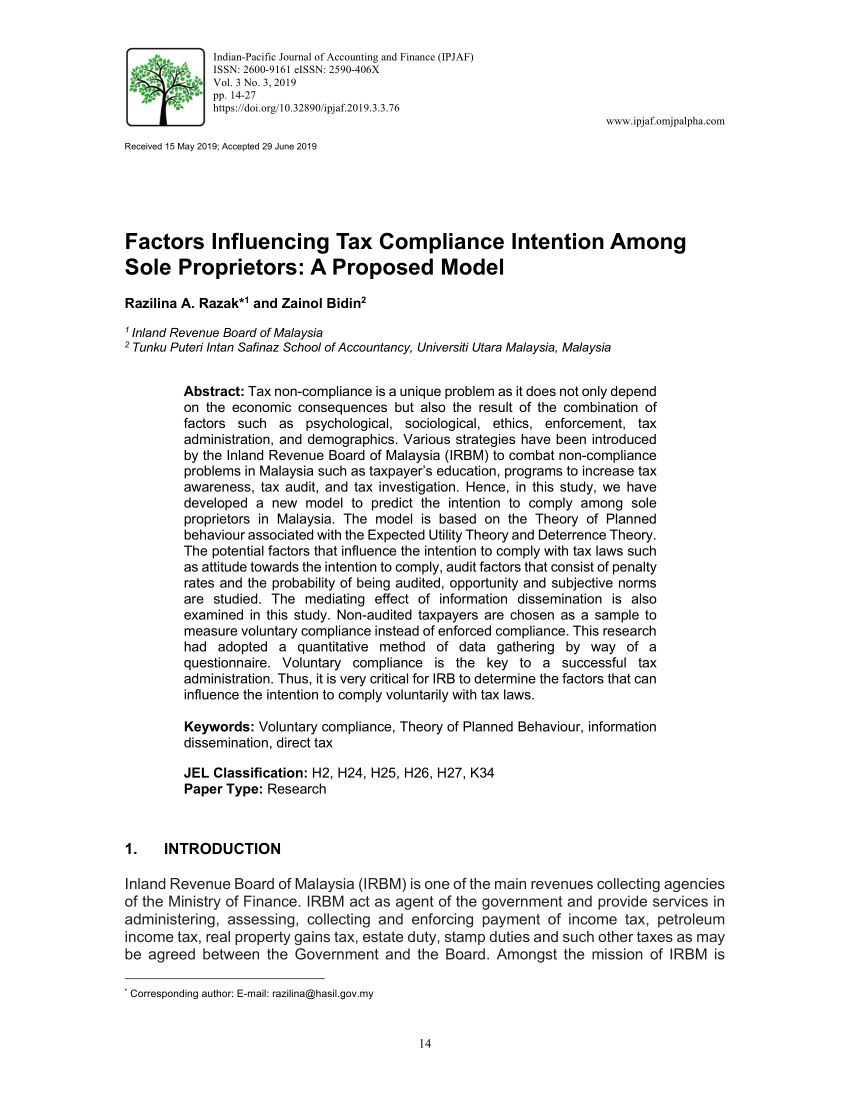

Pdf Factors Influencing Tax Compliance Intention Among Sole Proprietors A Proposed Model

Sole Proprietor Tax Forms Everything You Ll Need In 2022

How To Form An Llc Advantages Disadvantages Wolters Kluwer

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

Comments

Post a Comment